Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Your Crypto Tax Journey Starts Here!

Learn everything you need about crypto tax in our 5-session course.

It’s designed to give absolute beginners the knowledge to handle their cryptocurrency tax reporting with confidence, using crypto tax software.

You will learn…

How to set up Koinly, a leading crypto tax platform & master the dashboard

How to review and edit your transaction in Koinly for accurate crypto accounting

How to reconcile your Koinly accounts & fix errors for precise digital asset reporting

How to generate tax - ready reports with Koinly, simplifying your crypto tax reporting process using advanced tax reporting platforms.

Buy now to secure today’s rate and enjoy the full value of this comprehensive crypto tax course before pricing increases.

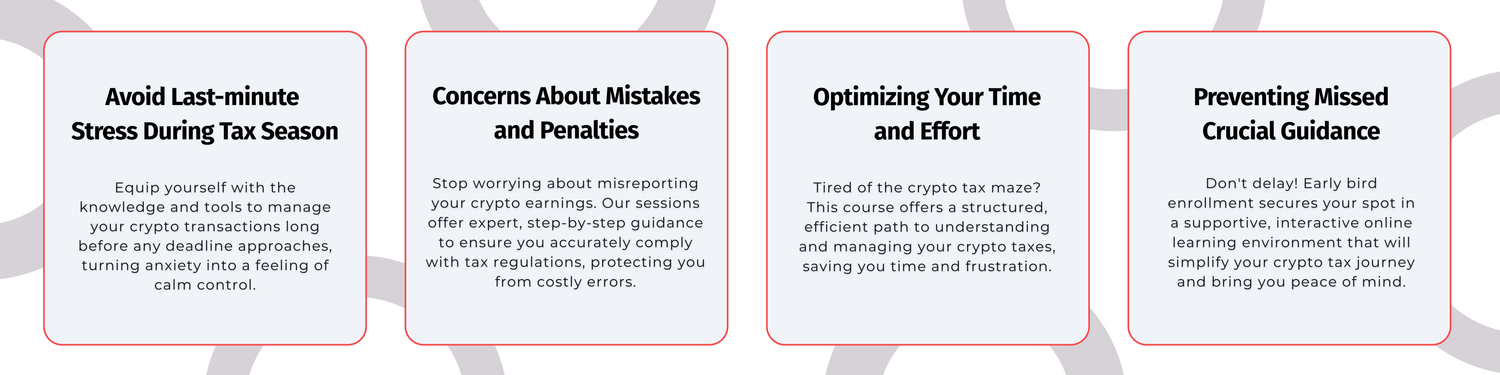

Does this resonate with you?

Do you struggle to track all your crypto transactions across wallets and exchanges?

Tracking across multiple platforms can be overwhelming. CTAcademy teaches you how to organize and automate this process using crypto tax software like koinly, so your tax data is complete and accurate.

Do you understand which crypto activities are taxable?

Many investors overlooked taxable events like staking, airdrops, of NFT sales. CTAcademy's crypto tax course explains what's taxable and why, including capital gains tax implications, so you can file correctly and avoid costly mistakes.

Do you transfer crypto between wallets and assume it doesn't affect your taxes?

Internal transfers aren't taxable, but they need to be properly tracked. CTAcademy shows you how to label and manage these transactions to prevent misreporting and optimize your crypto tax strategy.

Do you wait until tax season to start organizing your crypto data?

Last-minute prep often leads to errors and stress. CTAcademy gives you a simple system to stay organized year-round, making tax time smooth and efficient with the help of our recommended crypto tax platform.

Lock in the best price now and enjoy the full course value, including expert crypto tax help.

What you'll learn in these sessions....

See more preview videos below.

Quick Setup: Learn to set up your Koinly account and master the dashboard quickly, getting started with top-tier crypto tax software.

Easy Data Import: Discover how to seamlessly import all your crypto exchange and wallet data.

Confident Review: Understand & edit crypto transactions and their tax implications for precise reporting.

Accurate Reporting: Reconcile accounts to fix errors and confidently generate tax-ready reports, ensuring compliance with crypto tax forms and regulations.

What Our Sessions Cover: Your Path to Crypto Tax Confidence

Who are these sessions for?

New Crypto Investors/Traders: Anyone who's recently started buying, selling or trading crypto and need guidance on crypto tax.

"HODLers" With First Taxable Events: Individuals holding crypto who are now making their first sales or trades and need to understand their tax obligations.

Crypto Income Earners: Those receiving crypto from mining, staking, airdrops, or as payment, who need to navigate the complexities of cryptocurrency tax reporting platforms.

Overwhelmed Crypto Users: Anyone finding crypto tax rules confusing or complex, regardless of experience.

Get to Know Your Coach

Andrew, is a professional who helps crypto traders, investors, and accountants simplify crypto portfolio tracking and tax reporting. He has expertise in bookkeeping, cryptocurrency education, portfolio optimization, and data analysis.

With over 10 years of experience in the industry—including 7 years running his own practice and 5 years as an active crypto trader—he offers guidance and support to help clients stay compliant and organized across multiple exchanges and blockchains using advanced crypto tax software.

Whether you're just starting with crypto or looking to streamline your existing activity, a crypto tax coach can provide the tools, systems, and knowledge you need to track your portfolio and file with confidence.

Still Not Sure if This Sessions are For You?

Join us to transform your crypto tax journey and start writing your own success story today. We're waiting for you!

Stay connected with CT Academy!

Get course updates, exclusive discounts, and trusted crypto tax tips—delivered straight to your inbox.

Hate spam? So do we. Your email is 100% safe.